Were You Scammed By The Credit Manager Program?

Victims of the Credit Manager scam have faced significant financial and emotional distress. Promised a full suite of credit repair services with leads provided, they were instead left with substantial monetary losses and no clients.

The company offers to build you a credit repair business which includes leads that convert. The sad reality is that you get broken promises and delays. I’ve talked to investors in this program that have waited over 3 years to get a return on their investment and still nothing to show for it.

A normal company would realize that what they’re selling isn’t working and offer a new product/service or close shop. Credit Manager keeps on selling the same program and after years of excuses into why there are little to no leads, doubles down and runs ad campaigns to get more investors that they can’t properly service.

Just to clarify this is a scam perpetuated by Kevin Lam aka Van Lam. The main sites he uses are CreditManagerLaunch.com and RankAboveOthers.com . When your credit card is charged it is to Rank Above Others, Inc.

Update: December 21, 2024. He’s still running Facebook and Instagram ads for this scam service.

Understanding the Scam

The Promised Versus the Actual Services

The Credit Manager scam lures individuals with the promise of a comprehensive credit repair business in a box, designed to bring in leads and sales through advanced website design, strategic branding, and effective lead generation.

The reality starkly contrasts the initial promises. Victims who invested in the service found themselves with a website that can be valued between $300-$500.

Let’s break that down:

$100 website – go to Fiverr you can get a clone of any of their sites (all of the websites that they create have a very similar layout), then have the designer customize the color scheme, swap out content with ChatGPT, add your logo

$30 logo – go to Fiverr, you can get logos for $5+, there are free logo generators online

$97 CRM – Clixlo offers lifetime High Level access

$50 CRM configuration – go to Fiverr and pay someone to configure High Level for you

$35 domain and hosting for one year – Namecheap .com domain is $10.28 for a year, hosting is $22.88 for the first year

Total: $312

The site/stack that they use can be built for even less money but I wanted to give a real example.

The credit repair side of the business, has no value because there are no customers, since there are little to no leads provided and they don’t convert. I was told by a past credit repair customer that nothing was fixed on their credit, but credit repair does take time.

This stark discrepancy between the promised sophisticated tools and the delivered services highlights a clear intent to defraud. Numerous clients have reported similar experiences, indicating a pattern of deceit under the guise of starting a reputable and compliant done-for-you credit repair business.

They also mention that they have ongoing training. Newer purchasers of this scam have not received any training. In fact they have a Facebook group for purchasers that new members are never invited to.

Most victims were defrauded in the range of $15,000 – $30,000 for a website that can be built for a few hundred dollars. The only real value in their offer is that they provide leads and without leads the website that is delivered is an expensive digital paperweight. With the amount of money victims invested; this company could have easily paid for ads to get leads flowing, but instead pocketed the funds and uses the funds to purchase Facebook ads to defraud other unsuspecting victims.

Want your money back? No problem, they have a no refund guarantee. Several investors in this program were promised refunds if no leads came in by X date, then X date comes around and they are given more excuses.

Sign The Scam Victim Affidavit

By signing this affidavit, you not only obtain a copy for your records, but you also empower yourself and others affected by this scam to pursue legal recourse, including potential lawsuits, chargebacks, and other legal actions. Your participation in this process serves to advocate for justice and provides support to fellow victims in seeking restitution for damages incurred due to this fraudulent scheme.

By signing this affidavit, you acknowledge and consent to its potential dissemination to relevant parties, including but not limited to banks, credit card processors, individuals who may have been similarly affected by the scam, and attorneys engaged in seeking legal remedies. Your agreement to share this document contributes to collective efforts aimed at addressing and rectifying the situation, ensuring accountability and pursuing justice for all impacted parties.

If you have any questions regarding this form or require modifications to accommodate your unique circumstances, please don’t hesitate to contact us below. We are committed to tailoring a version of this document specific to your situation to ensure accuracy and relevance.

Tell Us Your Story

This a compilation of stories that I’ve gotten from speaking to past investors in the Credit Manager program. So far I have not seen one positive testimonial. Tell us your story, whether positive or negative below.

Purchased Late 2020

As an initial investor and purchaser, they made their first payment in late 2020. Despite expectations, they received no leads for an extended period, followed by a period of fake leads. Leads were called to verify if they were real and the leads had no idea that they were on a credit repair list. Fake leads were provided to this person.

One Lead In Almost 2 Years

Having paid $30,000 almost two years ago, they have only received a single lead during that timeframe, which didn’t convert into a client. They also became a paying customer for credit repair services, they have observed minimal, if any, effects on their credit report after months of engagement.

September 2023 Purchase

Having made their purchase September 2023, they have yet to see any results from their investment.

Site Live Since January 2024, No Leads

After their site went live on January 2024, they have yet to receive any leads.

Forced To File For Bankruptcy

Purchasing the service approximately 2-3 years ago as an initial investor and buyer, they have experienced no return on their investment. Despite paying $20,000, they received only one “lead” which failed to convert. The lack of returns from this service and investment contributed to their filing for Chapter 13 bankruptcy. They expressed frustration with the company’s consistent excuses for lead delays, with new excuses arising every few months. Their decision to invest was motivated by the promise of unlimited leads, which has not been fulfilled to this day.

No Refunds And They Fight Disputes

Purchase was made in August 2023, in January 2024 contacted Credit Manager to get an update because the site that Credit Manager created was receiving no traffic and there were no leads in the pipelineand was ignored for a couple of weeks, went back and forth with customer support and told no refunds. Initiated multiple disputes/chargebacks with payment processors that lasted a few months. Currently one dispute is still pending, the other two were dismissed due to improper handling by the bank.

Reach Out for Support

If you have been affected by the Credit Manager scam, please don’t hesitate to contact us. Your experiences are important, and together, we can seek justice.

All of the fields on the contact form are optional, this means that you can share as little or as much information as you’d like.

Feel free to ask any questions or share your experience with us.

Still Running Ads To Scam More People

You can live view the ads that they run on Facebook.

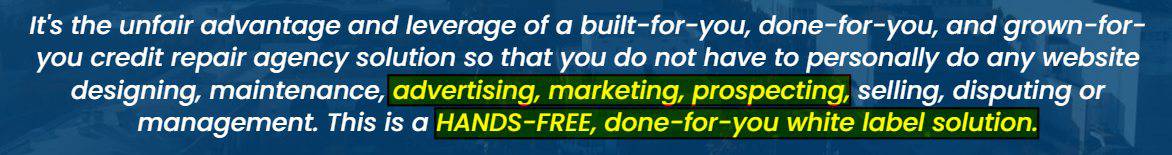

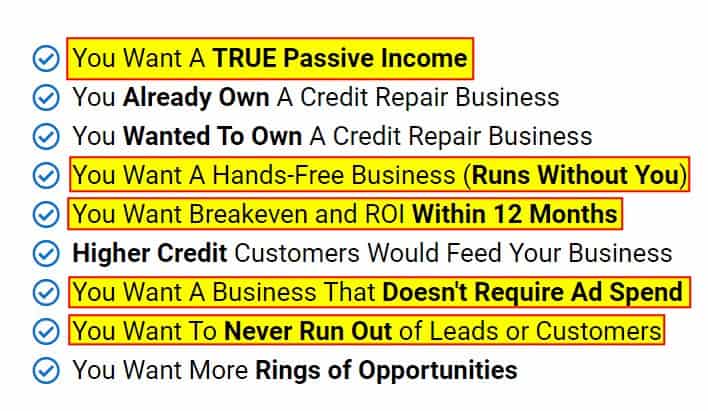

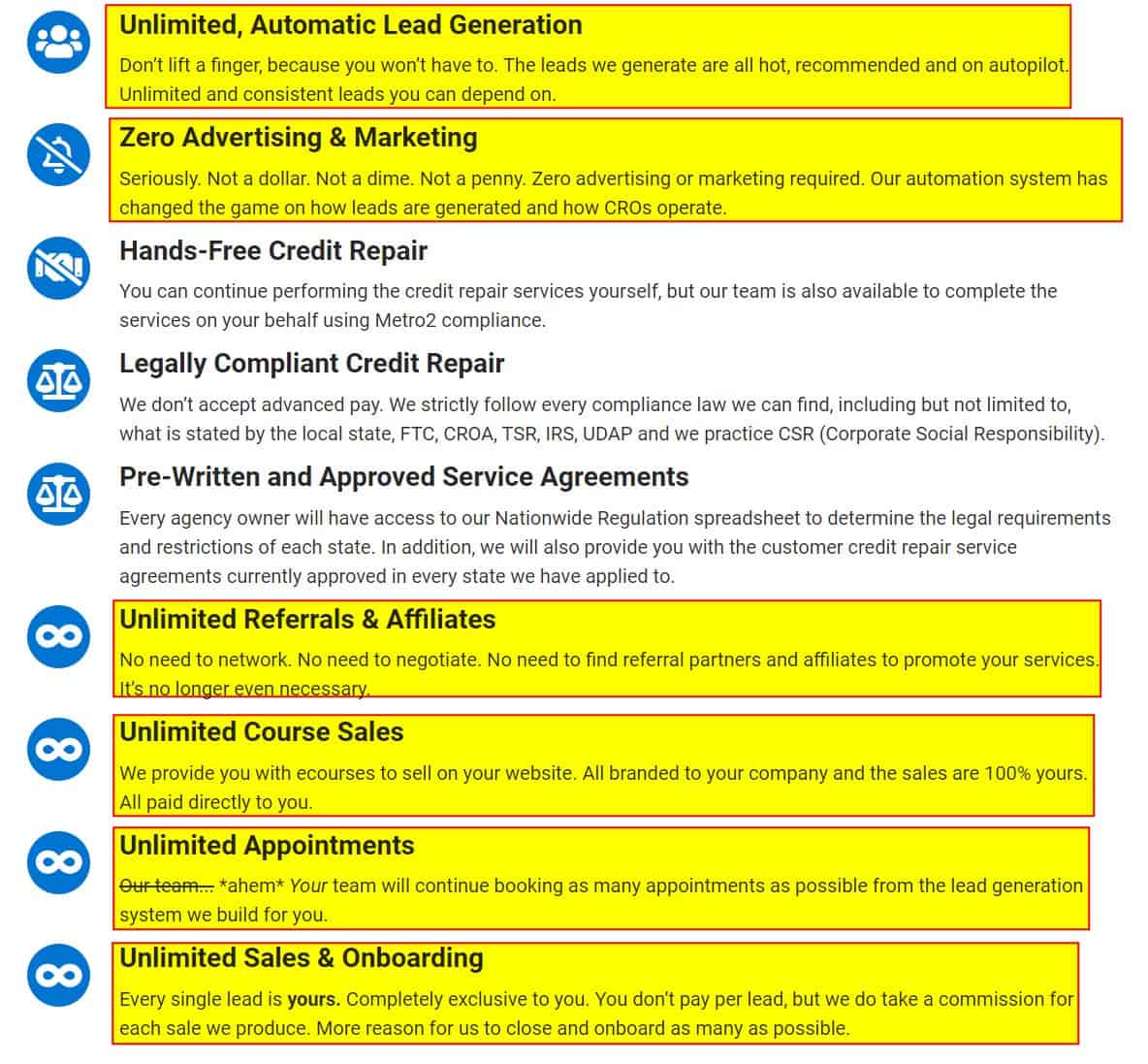

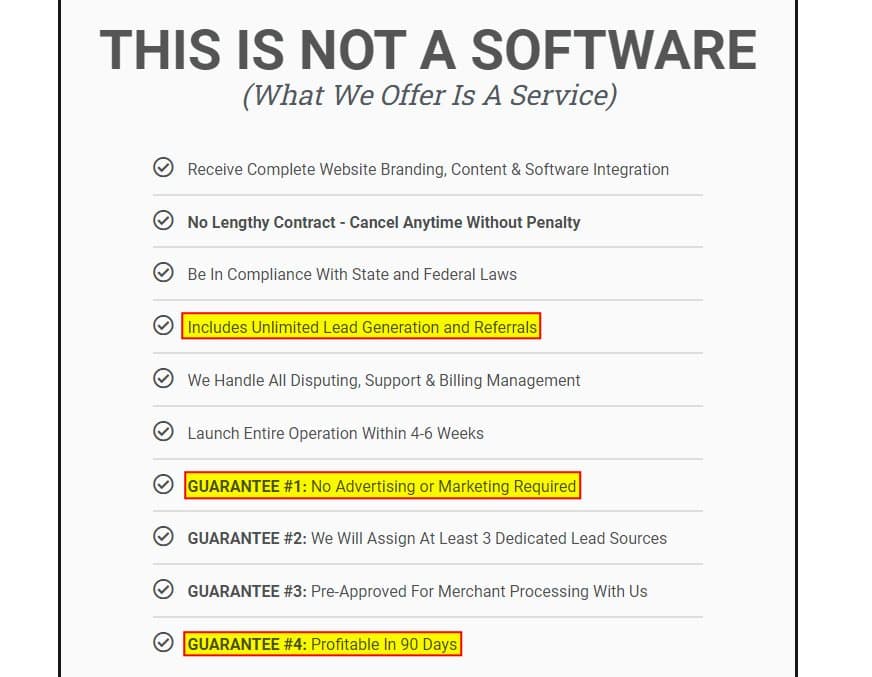

Current Sales Page Highlights As of 04/18/2024

There are so many lies on this page, that it’s unbelievable. Highlighted in yellow are what I experienced as being lies.

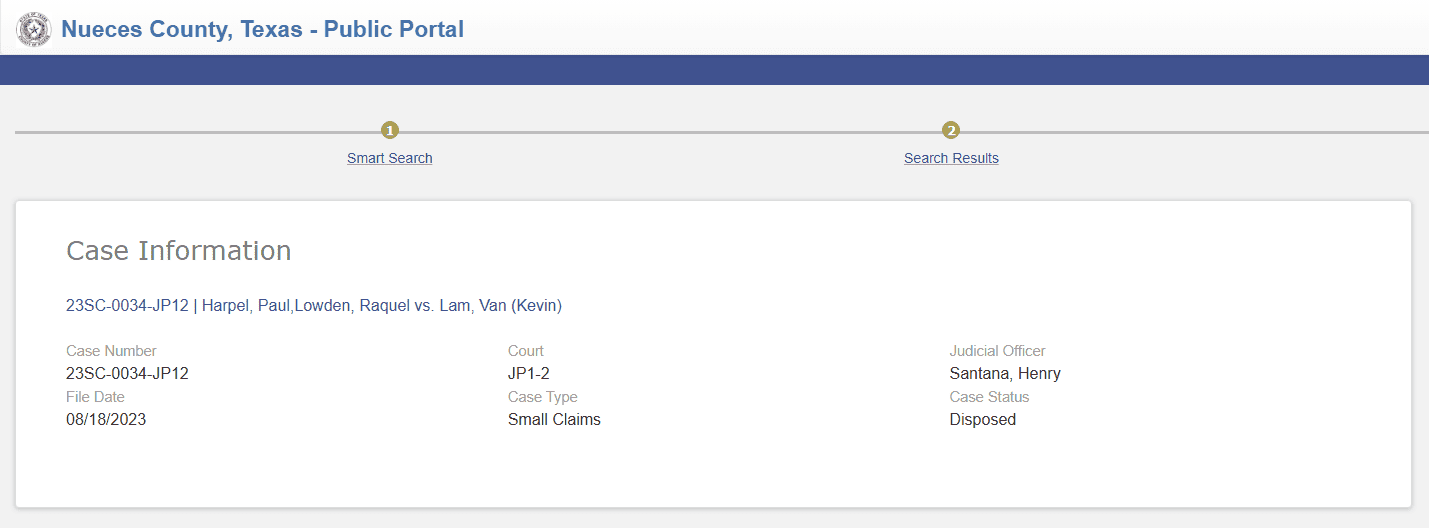

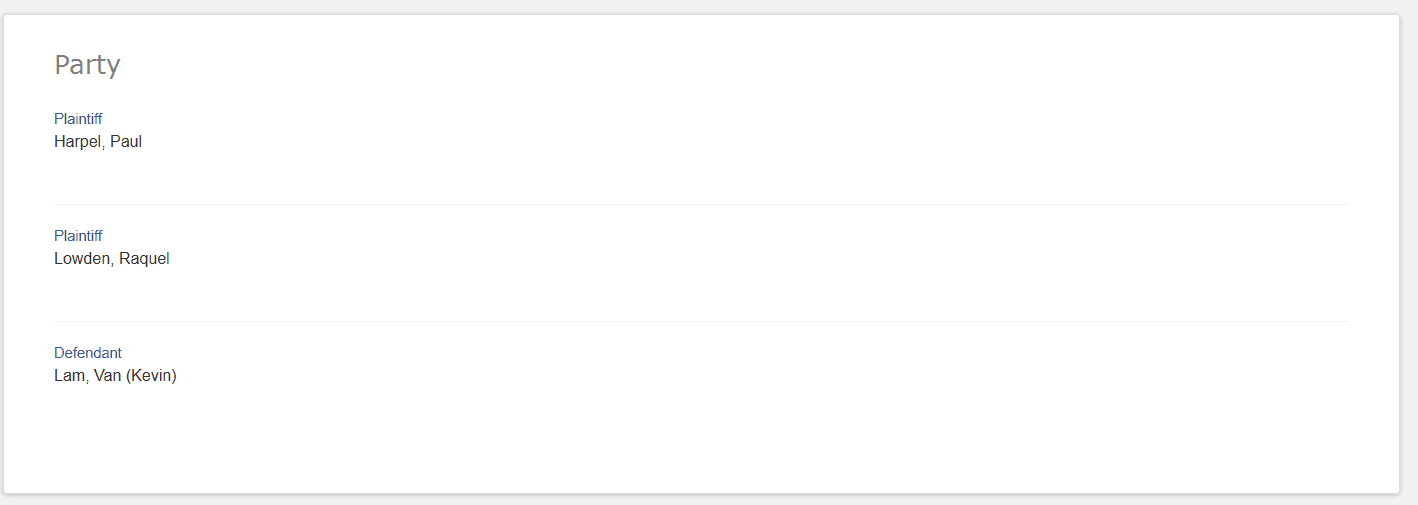

Scammer Kevin Lam Was Recently Sued

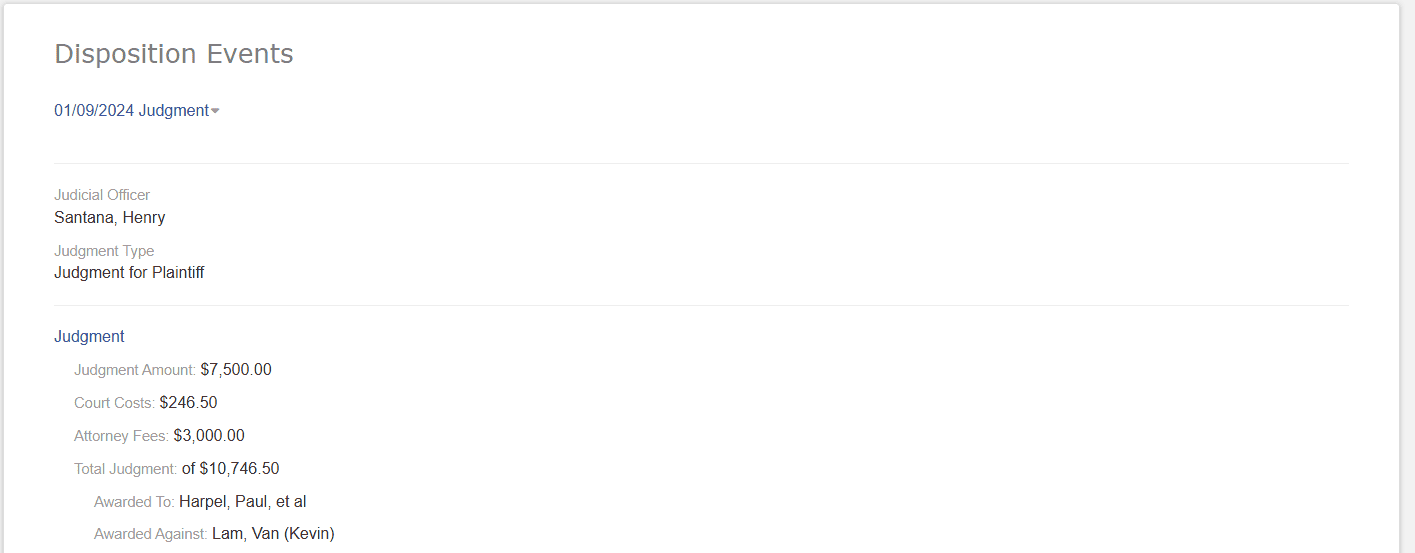

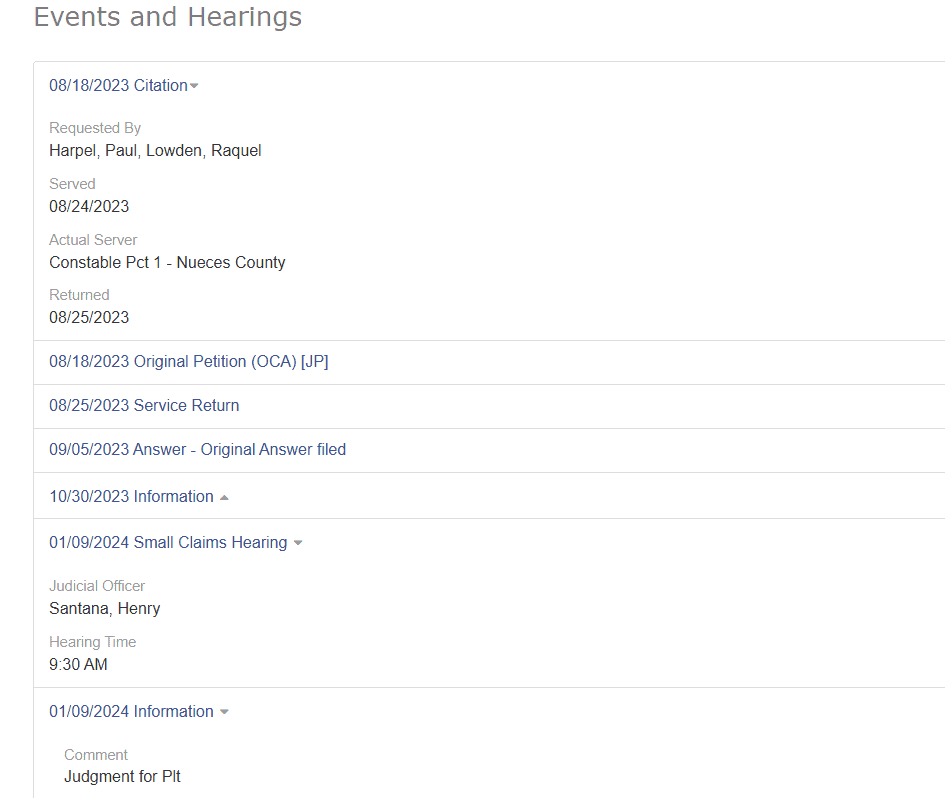

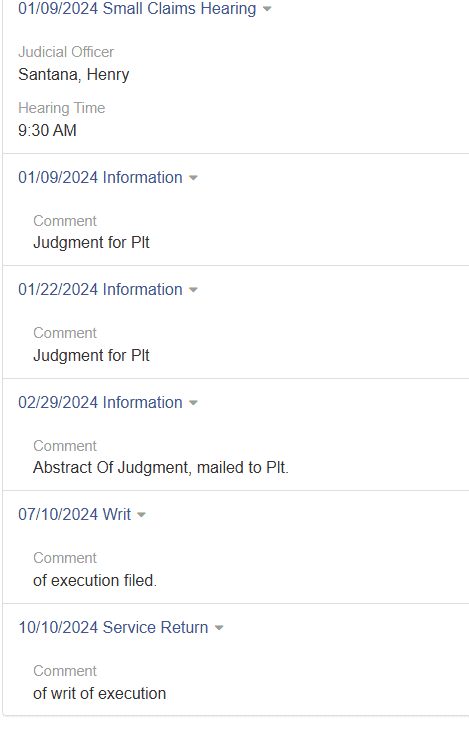

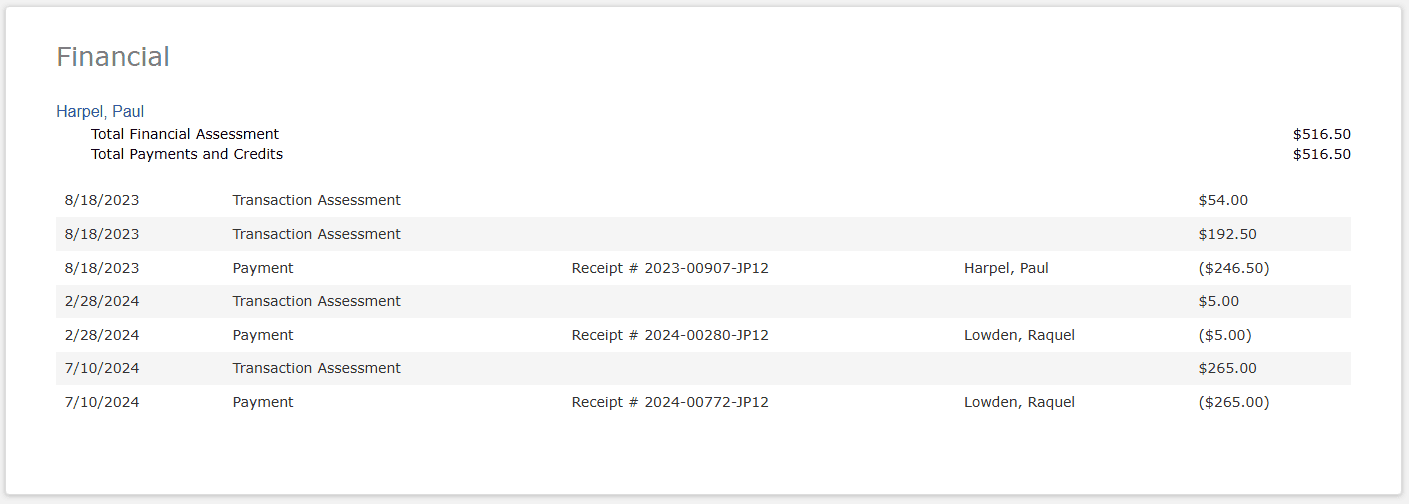

On 08/18/2023 he was sued in Nueces County Small Claims Court. The judgement was made for the plaintiff so Van Lam lost in court. As of this writing 12/21/2024 it looks like the plaintiff has been unable to collect on the suit. If you’d like to view the lawsuit in full, you can view it at the Nueces County Public Portal. Put in case number: 23SC-0034-JP12.

Take Immediate Action

If you suspect you’ve fallen victim to the Credit Manager scam, it’s crucial to report the incident and seek legal advice immediately. Contact your bank as soon as possible to try to recoup your funds, because you may lose your investment. This is no longer an investment into a failed business, but an investment sold under false pretenses (leads included). Protect yourself and help prevent others from falling victim.

Leave Your Comments Below

Have a story you’d like to share publicly or any comments? Feel free to post here. You can either choose to remain anonymous or give your real name, it’s up to you.

0 Comments